Common mistakes and solutions while updating Udyam Registration

Table Of Content

Introduction

MSMEs should always update their Udyam registration to keep their business details

accurate

and comply with government regulations. But sometimes business owners make some common

mistakes while updating their Udyam Registration Certificate, due to which their

registration may

face delays, rejections, or sometimes even penalties.

So through this blog, we understand the frequent mistakes made while updating Udyam

registration and how we can avoid them and make the Udyam certificate update process

even

smoother without any hassle.

1. Incorrect NIC Code Selection

What is the meaning of the NIC code?

The NIC code is a 5-digit unique code that helps in categorising the economic activity of a business. The NIC Code is used by the government, MSME businesses, and other organisations for various purposes.

Therefore, it is very important to select the correct NIC code while updating the Udyam registration, and with the correct NIC code, you can ensure the proper classification of your industry.

Common Mistakes While Selecting NIC Code

- Choosing Irrelevant Codes: Many business owners choose irrelevant NIC codes that are not related to their primary business activity, due to which they face a lot of difficulties in filing taxes and are not able to avail themselves of government benefits.

- Selecting unnecessary multiple NIC activities, codes: Sometimes, some businesses are engaged in multiple activities, due to which they select multiple NIC codes. Actually, they are not required, and even if they create a lot of confusion, their applications also get rejected.

- Not updating the NIC code after business expansion: If your business has expanded to a new sector or you have transferred your business and you are not updating your old NIC code because of this, the classification of your business remains inaccurate.

How can this error be avoided?

- Use the official NIC code listed on the MSME portal

- Before updating, identify your business's primary and secondary activities

- If you are not sure what the appropriate NIC code of your business is, then you can take guidance from experts.

- Our Udyam Registration portal will assist you in choosing the correct NIC codes.

2. Wrong investment and turnover declaration

Investment and turnover required in enterprise registration

Classification of micro, small, and medium enterprises is done based on investment and annual turnover of plant and machinery.

Common mistakes are made while declaring investment and turnover.

- Giving outdated and incorrect financial data: Many businesses enter incorrect financial details, which leads to misclassification and are not classified properly, whether it is a micro, small, or medium enterprise.

- Overestimating or underestimating turnover: If your turnover data is incorrect, the classification of the business also becomes incorrect, and the benefit that you get in your particular category under MSME schemes is not available.

How can this error be avoided?

- By getting the financial statement audited thoroughly and by entering the latest ITR details in accurate figures.

- By understanding the guidelines of the classification of MSME thoroughly and by making sure your investment in plant and machinery matches MSME guidelines.

- If the size of your business changes, keep updating your Udyam details accurately and regularly.

3. Mismatch of Aadhaar and PAN details

Why are Aadhaar and PAN details necessary?

The Udyam registration process is an online process that is Aadhaar-based, and the PAN details are linked with the financial records. If there is any mismatch in these details, then the application for Udyam registration gets rejected, or some errors occur for MSME certificate registration.

A common issue is related to Aadhaar and PAN mismatch

- Name mismatch: When you get your Udyam registered, your name should exactly match the name that is on your Aadhaar card or PAN records

- Getting PAN linked incorrectly: Some businesses give their personal PAN number by mistake instead of their business PAN number.

- Aadhaar details that are non-updated: If your Aadhaar details, such as name, date of birth, and mobile number, are outdated, then your registration process may also be problematic.

How can this error be avoided?

- Ensure that your name, date of birth, or business details match exactly with the records in your Aadhaar and PAN card.

- Provide the same mobile number that is linked to your Aadhaar. With its help, OTP verification is done very easily.

- If your details have become outdated or old, update them immediately in your Aadhaar and PAN database before registering the Udyam certificate.

How can these errors in Udyam registration be corrected?

If you have already made mistakes while updating your Udyam registration certificate, you can correct it by following some simple steps through the Udyam registration portal.

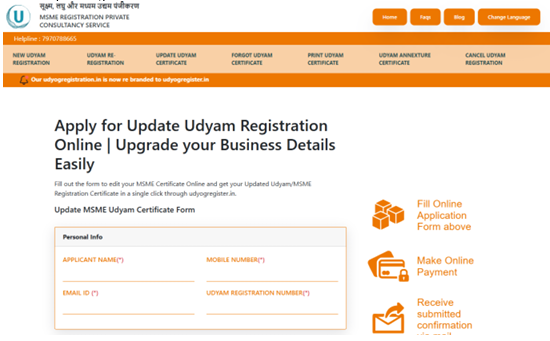

Step 1: First of all, go to the Udyam Registration Portal

- Select an authentic Udyam-related website like the Udyam Registration Portal.

- Navigate to the home page and select the “Udyam Update Certificate” option.

- In a moment, the Udyam Certificate form will be displayed on your screen.

Step 2: Fill in the personal information

- Enter the applicant's name.

- Enter your mobile number.

- Enter your email ID.

- Enter Udyam Registration Number.

Note: The Mobile number should be the same as the one registered in your Udyam Registration.

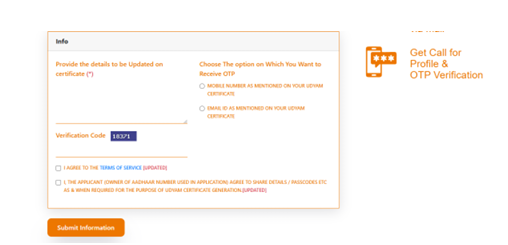

Step 3: Provide the details you want to update

- List the given box that you want to modify in your Udyam Certificate. For example: Business Name, Address, Contact Details, Nickname, etc.

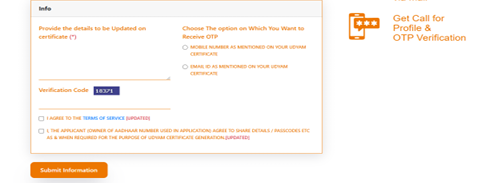

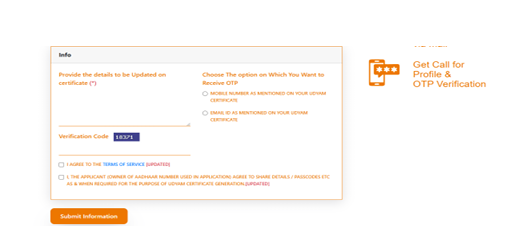

Step 4: Choose the OTP Verification Method

- Mobile Number: The Mobile number should be the same as the one mentioned in your Udyam Certificate.

- Email ID: Email ID should be the same as the one mentioned in your Udyam Certificate.

Select where you want your OTP to be sent to prove your process is authentic.

Step 5: Enter the verification code

- You will see a CAPTCHA or verification code on the screen. Fill it in correctly in the given place.

- Tick the checkbox for terms and conditions and declaration.

Step 6: Submit the information

- By clicking on submit information, you can submit your information.

- After this, you will directly reach our payment gateway. Select the method given there through which you want to make a payment; for example, if you want to make a UPI, then you can make a payment by selecting the UPI method.

- After making the payment, you will get an OTP for verification. Then, fill in the OTP in the given field and verify it.

- Finally, you will receive a message of verification through email.

Once the update process of the enterprise is completed within 24 hours, you can download the updated Udyam certificate.

Conclusion

You can avoid the above common errors when you are updating your Udyam registration, and you can also avoid unnecessary delays, application rejections, and compliance issues, due to which your time is also saved.

Whether you are applying for a new Udyam registration or updating your existing Udyam registration, ensure that your selection of NIC code is accurate and your financial declaration is correct, and if the details of your documents are very detailed, keep them updated and enter them correctly.

If you want to do Udyam registration online without any hassle or want to make any corrections, then visit our website. You will get expert assistance through our website, or if you want to get any information about it, then you can contact us. We are ready to make your Udyam registration process smooth and seamless.

About the author

Aaushi Sefali, who specialised in content, article, and blog writing. She delivers accurate, impactful, and relevant content about the topic.